All services

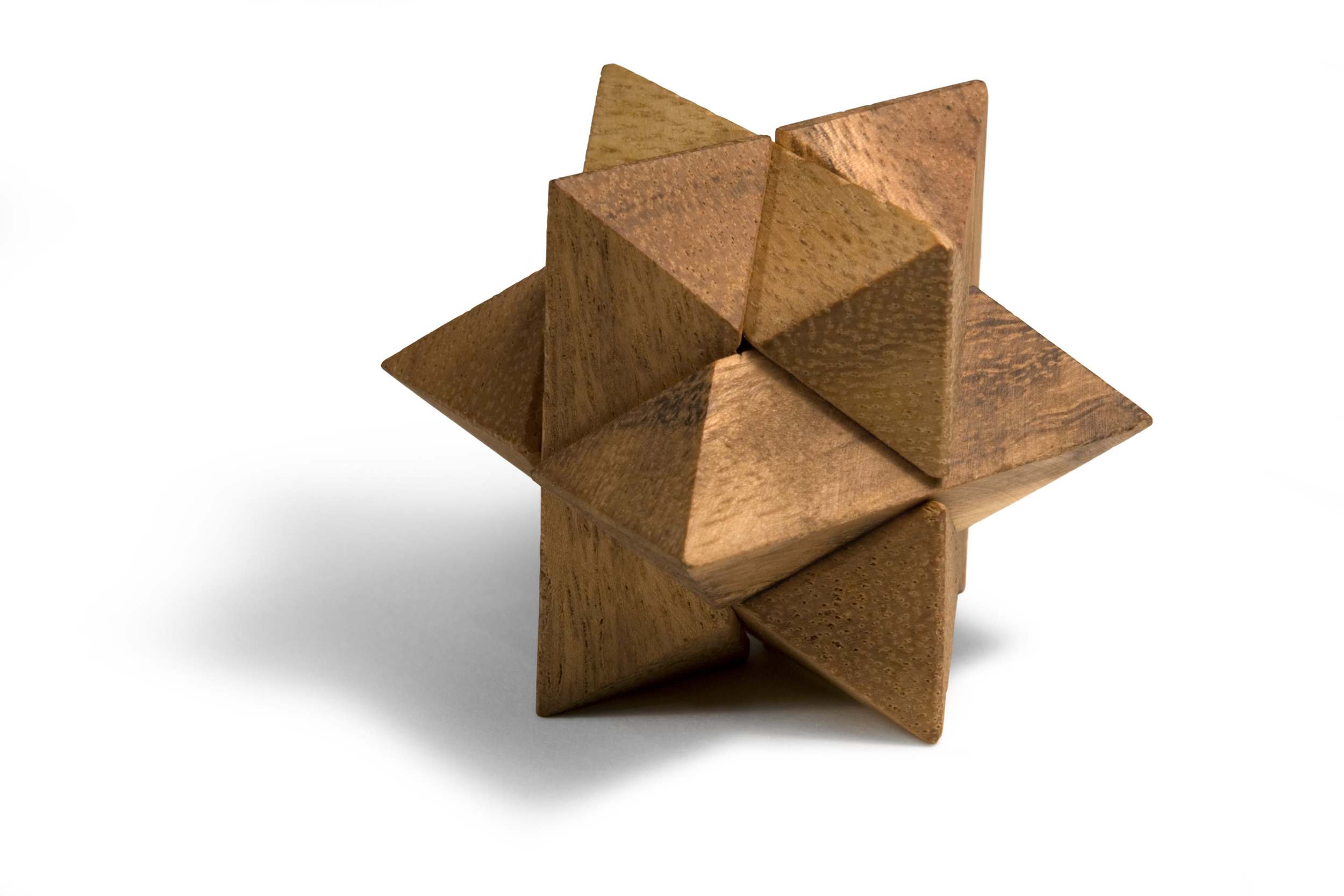

To solve the puzzle below you will need to find a way to assemble many different pieces. When you do the result is a sturdy object, far stronger than the sum of the parts. Throw it in the air; it will not come apart. Similarly, we will work with you to select the appropriate services to create a cohesive solution to your needs and make life easier.

The selection of services below is "a la carte". We can work with you on either a comprehensive or selective basis, in-depth or supplemental to your efforts and those of other professionals. For example, we have provided all-encompassing advice to four generations of one family. With that relationship, we provided full investment management, tax, wealth transfer, estate planning and reporting advice. We also serve individuals wanting less extensive help in the form of investment oversight, tax review or paying bills.

We do not receive third party benefit from any of the services. The advice you receive is totally independent. Our work is a combination of efforts directly for you and a collaborative effort, coordinating your other advisers. All advice is confidential and at a fiduciary standard.

making sure your records are in order

Maintaining proper records is important for your convenience and in the event something happens to you. We can help you to organize yourself in many ways.

- Review and organize your important documents such as wills, trusts, deeds and financial records, so access to information is readily available in a physical or digital form.

- Make sure all your assets and debts are accounted for and titled appropriately.

- Provide periodic reporting (monthly, quarterly or yearly) on the cost and value of all your possessions in the form of personal financial statements that would include:

- Securities

- Business interests

- Real Estate

- Personal Property (jewelry, cars, etc.)

- Collectibles and other assets or debts

Whether you manage your money yourself, use one adviser or many advisers we will provide an independent perspective.

- Help you review the investment returns. Meet with you separately or with investment managers.

- Coordinate multiple advisers to ensure proper diversification and consistency with your investment and retirement goals.

- Combine all your investment holdings, whether managed by you or others, into a single clear report.

- Explain terms, concepts and investment approaches.

- Help with your selection of managers.

Recording Income and Paying Bills

We pay bills, whether to save you timeor for a loved one wanting the confidence of proer and timely payment. As a natural extension of that, we can work with you to develop a financial plan that looks at your spending for living expenses, taxes, gifts and charity in consideration of your current and retirement goals.

- Review the invoices for appropriateness.

- Pay bills electronically or by check with your direct authorization or through an authorized account.

- Prepare a report detailing expenses for your review, useful at tax time to ensure you receive all possible deductions to lower your taxes.

- Maintain records of monthly income.

- Prepare a financial plan that will provide guidance on whether your spending is in line with your income and your long term goals.

Tax Coordination

We have a long history of managing clients' income, gift, trust, partnership or business tax obligations. Our understanding of your overall financial picture can help minimize your tax obligation.

- Work with your existing tax professional or facilitate tax preparation for you.

- Orchestrate document collection to ensure completeness of records.

- Help you take advantage of all opportunities to save taxes prudently.

- Review returns from third-party preparers.

- Provide tax planning with an understanding of all aspects of your financial picture.

- Pay estimated taxes on a timely basis to avoid penalties.

- Maintain cost basis information for all assets: securities, real estate, collections.

Coordinate domestic help

Managing domestic employees, with the associated tax and unemployment insurance filings, is time-consuming and confusing. Making a mistake can result in penalties. We can help.

- Coordinate domestic help whether cleaning staff, yard employees or caregivers generally through agencies but in certain instances directly as well.

- Prepare payroll checks, do government filings and pay taxes.

- Orchestrate background checks through an outside service.

- Provide information required for your income taxes.

Real estate management

Investment property can provide good cash flow and vacation homes much enjoyment, but they involve time-consuming oversight.

- Provide property oversight, generally through property managers and sometimes directly, to free up your time.

- Pay the expenses and record income associated with rentals.

- Create reports that detail income and expenses for your use and tax preparation.

Business Entities

We provide a range of services for small business entities that can help you in many ways.

- Provide bookkeeping services for your small business or venture.

- Provide detailed financial modeling to analyze your existing operations and help you make strategic decisions.

- Research, analyze and model new ventures.

- Integrate with tax preparation and planning, understanding the interplay with your personal taxes.

Charitable Giving

Charitable giving can become an important and rewarding part of your life but requires careful record keeping. We can help you address that.

- Issue checks and monitor IRS required acknowledgment to support the charitable deduction.

- Maintain a record of current year's gifts to help plan for future years.

- Advise on and orchestrate "in-kind" contributions in the form of marketable securities or other non-cash assets.

- Help establish private foundations and coordinate tax preparation.

- Ensure private foundation compliance with IRS regulations to preserve non-profit tax status or avoid penalties.

- Monitor contributions to minimize excise tax.

Coordinate Advisers

Families may have several advisers; lawyers, accountants, investment managers, bankers and insurance brokers. We can help you leverage the benefits of your advisers through effective coordination because we have a picture of your financial life that no one other adviser has. Some examples:

- Make sure your estate plan is reviewed and revised every few years or whenever tax laws change to make sure it reflects your intentions.

- Implement and monitor wealth transfer planning.

- Create financial models to evaluate alternatives.

- Communicate strategies to you and other family members.

- Orchestrate insurance reviews (life, health, property & casualty) to make sure coverage is appropriate for you.

Work with the other family members

Individuals and families have legitimate concerns about how their children or spouses handle money, regardless of wealth. It is important to instill family members with a healthy sense of purpose and financial responsibility. Further families with a shared asset, whether a weekend cabin or a family business, may want to develop ways to make collective decisions.

- Explain to offspring/spouse what they own or will receive.

- Explain trusts.

- Assist other family members with budgeting.

- Provide family wealth education to help understand the impact of money on one's life.

- Coordinate family decision making and meetings.

One-time projects

- Organize documents as part of settling an estate, divorce or litigation

- Engage with you to facilitate projects that arise from time to time. We are enterprising and creative. We find solutions to situations that arise.